Solutions for you

We help when it matters

We do our utmost to accommodate you if you experience payment difficulties because of job loss, sickness or other reasons.

Solutions for you

We offer various means to deal with payment difficulties. You can apply for a credit assessment in a matter of minutes and we’ll contact you to review the avenues open to you. In the app and online banking, you can change various limits, take Aukalán loans and smooth credit card bills.

Smooth credit card bills

You can smooth credit card bills across up to 12 months in Landsbankinn’s app and online banking, quickly and easily.

Smoothing bills is a useful tool to deal with irregular expenditure or to lighten the payment load temporarily. You decide on the amount you wish to pay on the next due date and the number of months over which you want to smooth the outstanding amount.

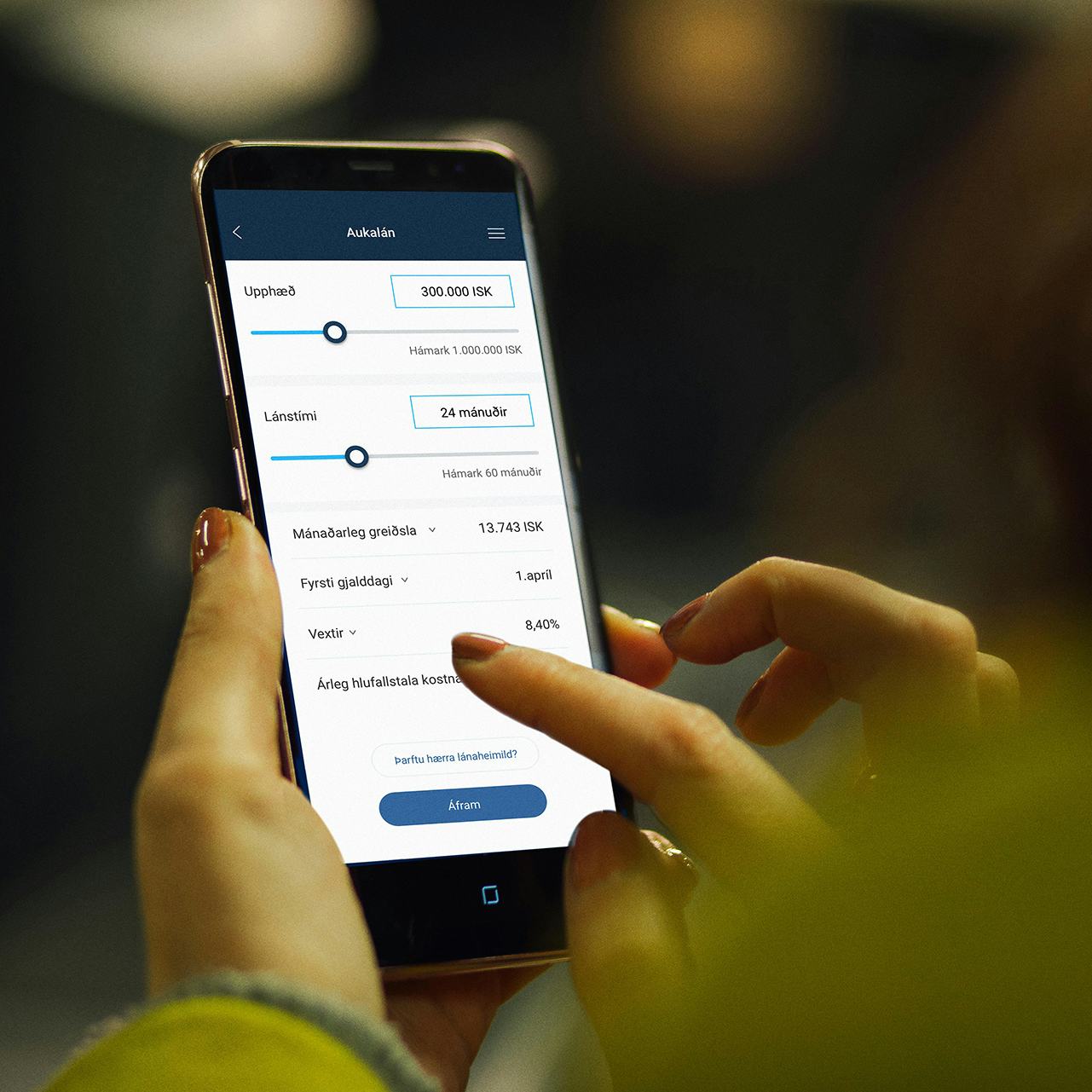

Aukalán loan

Do you need to cover unexpected expenses or loss of income? You can apply for an Aukalán loan in the app, quickly and easily. You can see at once the amount of credit available to you and the terms that apply. The loan is payable to an account or credit card immediately.

- Finalised in moments

- Up to 5-year term

- No payback charge

- No borrowing charge for Aukalán loans in the app

Overdraft

Customers enjoy flexibility in their finances and can use self-service solutions to apply for an overdraft authorisation, to increase, decrease and extend or cancel the authorisation both through online banking and the app.

Customers see immediately how much scope they have to obtain credit for themselves when it suits them. Please contact us if you require credit in excess of what is available in self service in the app and online banking.

Refinancing mortgages

Refinancing a mortgage can also be a good option to lower debt service in the long term. Interest rates and mortgage term change and it pays to compare your loans with other loans on offer at time.

Debtors' Ombudsman

If there are many creditors, the Bank may not be able to resolve the entire situation. If your creditors are numerous and you will soon experience or are already experiencing payment difficulties, you can apply to the Debtors' Ombudsman. The main function of the Debtors' Ombudsman is to improve the position of individuals who are in payment difficulties and help shoulder their payment and debt burden.

Join our group of satisfied customers

Applying for access to online banking and the app, creating an account and getting a debit card is a matter of minutes.